As new digital market opportunities emerge and evolving customer demands further add to the pressure of transformation, insurers who are still relying on legacy systems will find themselves far behind in the race for speed. Key to tackling this challenge is core modernization. A modernized core is no longer an ideal, but a critical necessity in order provide a unified platform with multiple digital touchpoints for business users and customers alike. Many insurers are already taking new steps to advance their core modernization journey, like streamlining their claims handling and quote/bind via tools such as automation.

As insurers modernize their core systems, one aspect they must pay extra attention to are the requirements gathering phase. This phase impacts the success of core modernization since it establishes the functional needs and technical capabilities to drive the company’s business objectives. This is especially true for system modernization projects where requirements for every function that the system supports needs to be documented. For example, workers compensation systems have many functions—including but not limited to wage replacement, medical care, payments to beneficiaries of the deceased, and return to work plan. Each of these functions and respective requirements must be analyzed and considered for how it will support the business in the new system.

An insurer partnered with ValueMomentum’s CoreLeverage team for a Duck Creek core modernization initiative. A focus of this project was on streamlining the requirements gathering phase of their workers compensation system. Here is an overview of how our team implemented automation to speed up the requirements process for the insurer.

Use Case: Accelerating Workers Comp Requirements Gathering

Our insurer client was looking to build a system that could account for the complex conditions that affect workers’ compensation, such as the nature of work and shifting economic or political landscapes. Manual systems plus a team lacking in business and overall experience further hindered their processing. To resolve this challenge, they needed a software that could quickly automate the requirements gathering phase of the full implementation project. This would pave space and time to compare and transition the legacy system to the new platform (Duck Creek).

ValueMomentum sought out a technology to assess the functional aspects of their specific requirements gathering phase and organize the analytics needed to move forward in the modernization project. Key to this was a tool that could extract all of the out-of-the-box (OOTB) requirements quickly and with ease.

Key technology: Applying Automation and Sustaining Innovation

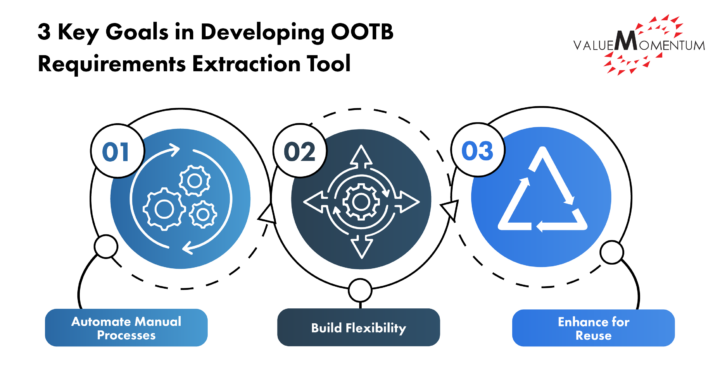

In creating this tool, the CoreLeverage team not only considered utilizing automation but also focused on designing something that could be reused in other areas, for other modernization projects. Three key goals guided the team’s development process:

-

Automate Manual Processes to Drive Speed and Quality

The insurer needed an accessible OOTB source system where the team could look at particular field identifiers and see whether or not that field was available in the OOTB template. If it was not available, the field would need to be modified. VM designed an automation tool that took the code from template manuscripts in the form of XML files, extracted the code into an Excel sheet, applied some common English language, and converted it into a requirement document.

-

Build Flexibility to Accommodate Updates and Changes

The team specifically utilized a Sustaining Innovation Approach to build this tool on the core platform. Sustaining Innovation aims to build on top of existing utility to release improvements and new features based on current market needs. This removes the need to build a platform from scratch, helping the insurer increase the ease of implementation and reduce the amount of manual effort.

-

Enhance for Reuse Across the Organization

The same tool has been deployed in other projects to help the insurer quickly gather OOTB requirements and compare data in the two systems. Automating this manual requirements gathering process is allowing insurers to accelerate the modernization journey and moving them one step closer to a streamlined insurance core.

Project Value: Leveraging Automation to Accelerate Data Modernization Journeys

Core modernization is no doubt critical for speed to market and operational efficiency of insurers’ key lines of business across claims processing, policy administration, and more. For insurers, recognizing the urgency to implement new tools to modernize core is the first step. To inject speed into the modernization journeys and remain competitive, insurers should take advantage of innovative technologies available in the market and apply tools such as automation to enhance the requirements gathering process.

ValueMomentum’s CoreLeverage team has helped insurers accelerate their core modernization. Along with the Sustaining Innovation Approach, the team has deployed the same tool in other legacy modernization projects, accelerating the insurer’s requirements gathering process and helping the insurer expand their capabilities to harmonize the technical and functional aspects of the development phase.

Our team’s core platform and insurance expertise can help carriers understand how to benefit from building certain utilities and enhance future modernization projects. By enabling sustaining innovation in the discovery stage, for example, we help our clients continue to maximize benefits and reduce manual legwork.

Need to transform your core systems to support your business growth strategy? Check out our CoreLeverage Services and learn how you can harness the innovative capabilities of modern platforms to make critical wins within your business.