Insurance incumbents today face a contradiction—how does one balance century-long histories and legacy systems, while also embracing next-gen technologies that promise new efficiencies, values, and capabilities? Despite the growing turn to full digital transformation, insurers’ challenges remain steadfastly the same—manual labor within business processes, big amounts of unstructured, underutilized data, and compliance and security risks.

A more holistic Intelligent Automation (IA) emerges as a solution against this background of challenges. IA is serving as a critical enabler for insurers to drive operational efficiency, advanced analytics, and improved customer experience.

A Holistic View on Intelligent Automation

Already, insurers have begun to implement automation tools across product cycles, quality engineering, and more. However, most insurers are still applying them in piecemeal silos and not treating it as a fundamental foundation where automation colors every business and technical process. This is where taking a holistic view to intelligent automation comes in: as a set of technologies, this approach to IA fruitfully combines diverse automation tools—such as AI, robotic process automation (RPA), and machine learning (ML)—to underlie an insurer’s full digital transformation and key functionalities.

Especially as insurers embrace expanded opportunities to collect data via IoT and new digital interactions across customers, processing that data requires its own tools. Holistic IA fills that gap and augments enterprise-wide processes with significant reductions across process turnarounds, manual labor, and human errors. With the help of an effective technology and integration partner, insurers can reap long-term business value with this grounded approach to intelligent automation.

Multiple insurers have partnered with ValueMomentum to develop personalized IA tools to resolve their unique pain points. For insurers seeking to identify areas to start applying intelligent automation and its tools holistically, let’s look at some of our insurance-specific use-cases.

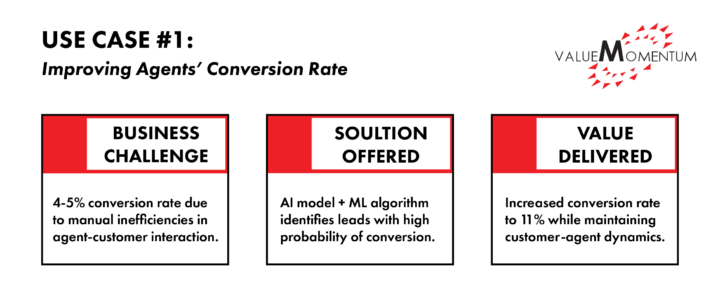

USE CASE #1: Improving Agents’ Conversion Rate

A century-old insurer experienced low conversation rates due to manual inefficiencies in the agent-customer interaction. When customers searched online, the system generated a specific quote for each customer. Agents would usually select random quotes and call the customer to assess interest from these searches. Out of 100 calls, on average only 4-5 customers converted. Recognizing the sheer inefficiency of this process, this insurer asked themselves: how could they utilize agents’ time more efficiently while increasing their conversation rate?

The insurer developed an AI model and machine learning algorithm that would automatically assess the probability of each customer’s conversion. Instead of selecting customers out of random, agents were now able to select specific set of leads with high probability of conversion and call them. Upon implementing this solution, their conversion rate rose to 11 percent. The tool preserved the traditional customer-agent dynamic while also streamlining the agents’ capacity to focus solely on customers likely to convert.

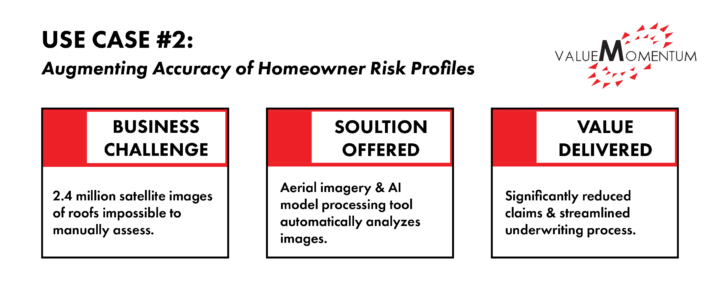

USE CASE #2. Augmenting Accuracy of Homeowner Risk Profiles

A mid-Atlantic insurer specializing in homeowners’ insurance made a key observation—out of all the submitted claims, more than 50-60 percent of them reported roof damage as the reason for claim. While they had satellite images of these roofs, it was impossible to manually assess the 2.4 million images they had. The insurer wanted an automation solution that could efficiently assess roof conditions to help underwriters’ issue more accurate premiums for customers.

To address this need, the insurer developed an aerial imagery and AI model processing tool that could automatically capture and analyze roof images via satellite and homeowner’s address. Based on the severity of damage, the insurer would then proactively email customers notifying them of the damage or shared a warning to rebuild. Without intervention, the system would flag damaged roofs and forward the images to the underwriter, who would then decide whether to increase the premium. This solution streamlined a cumbersome process for underwriters when assessing home risk profiles and also significantly reduced the overall number of claims.

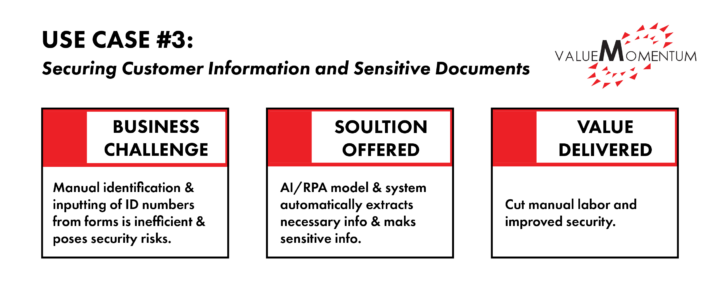

USE CASE #3: Securing Customer Information and Sensitive Documents

An India-based insurer required customers to submit legal identifications (ex. driver’s license, passport) after a policy was issued. Traditionally, agents and underwriters would manually identify ID numbers on submitted documents, extract them, and input in their databases. This naturally led to operational inefficiencies, but also security risks when agents failed to mask identification numbers of customers. The insurer needed an intelligence tool to identify the value of the customer’s submitted document while also securing extracted information.

The insurer implemented an AI/RPA model and system to automatically assess the proof of submission. It would identify the particular form of the document, extract the necessary information, and directly deliver it to relevant underwriters and agents. Another accompanying AI model then automatically masked sensitive customer information, cutting both manual labor and improving security.

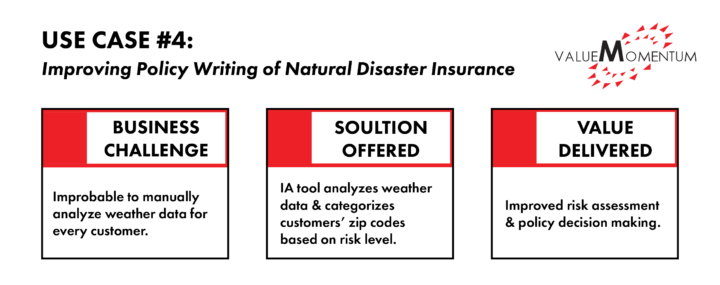

USE CASE #4: Improving Policy Writing of Natural Disaster Insurance

An insurer focused on commercial and personal lines struggled to accurately write policies within high-risk areas of natural disasters and harsh weather. Though they had access to public weather data, it was improbable to manually analyze each location’s data for every customer. They sought out an automation tool that could analyze this data quickly and improve their policy writing, especially when assessing geographic locations of high risk.

The insurer leveraged an IA tool that connected customers’ zip codes with weather patterns. The model would first analyze weather data and identify high risk areas. Based on this analysis, the model would then categorize customers’ zip codes across a number of safe to at-risk zones. This tool provided critical insight for underwriters to utilize, improving risk assessment and policy decision making.

Setting the Foundation for Intelligent Automation

As a set of tools, holistic intelligent automation promises a key benefit: the removal of manual, labor-intensive tasks within underwriting processes, agent-customer communication, and other core system capabilities. It not only improves customer experiences, but accelerates the efficiency, speed, and accuracy for insurers themselves. For savvy insurers, the tools that can balance the central tenets of insurance — agent and customer relationships, the elements of both risk assessment and risk mitigation — with advanced technologies are critical for continued value and growth.

The power of robotic process automation and machine learning is evolving at a rapid pace. Insurers who fail to utilize these automation tools will lose a significant competitive advantage against other incumbents as well as insurtechs that capitalize on next-gen technologies. Though the process to successfully implement intelligent automation requires its own strategy, a capable technology provider can lead this journey for insurers.

Ready to jumpstart your intelligent automation journey? See how VM’s ITSM automation services can help you develop personalized automation tools that can address your business goals, today!