Digital capabilities have been a dominant area of investment for property and casualty insurers for years, and artificial intelligence (AI) tools are not a new addition to carriers’ technology stacks. But, like many other industries, the insurance landscape is seeing a transformative addition to its tool set in the form of generative AI. Effectively leveraging generative AI in insurance could help unlock new pathways for strategic growth.

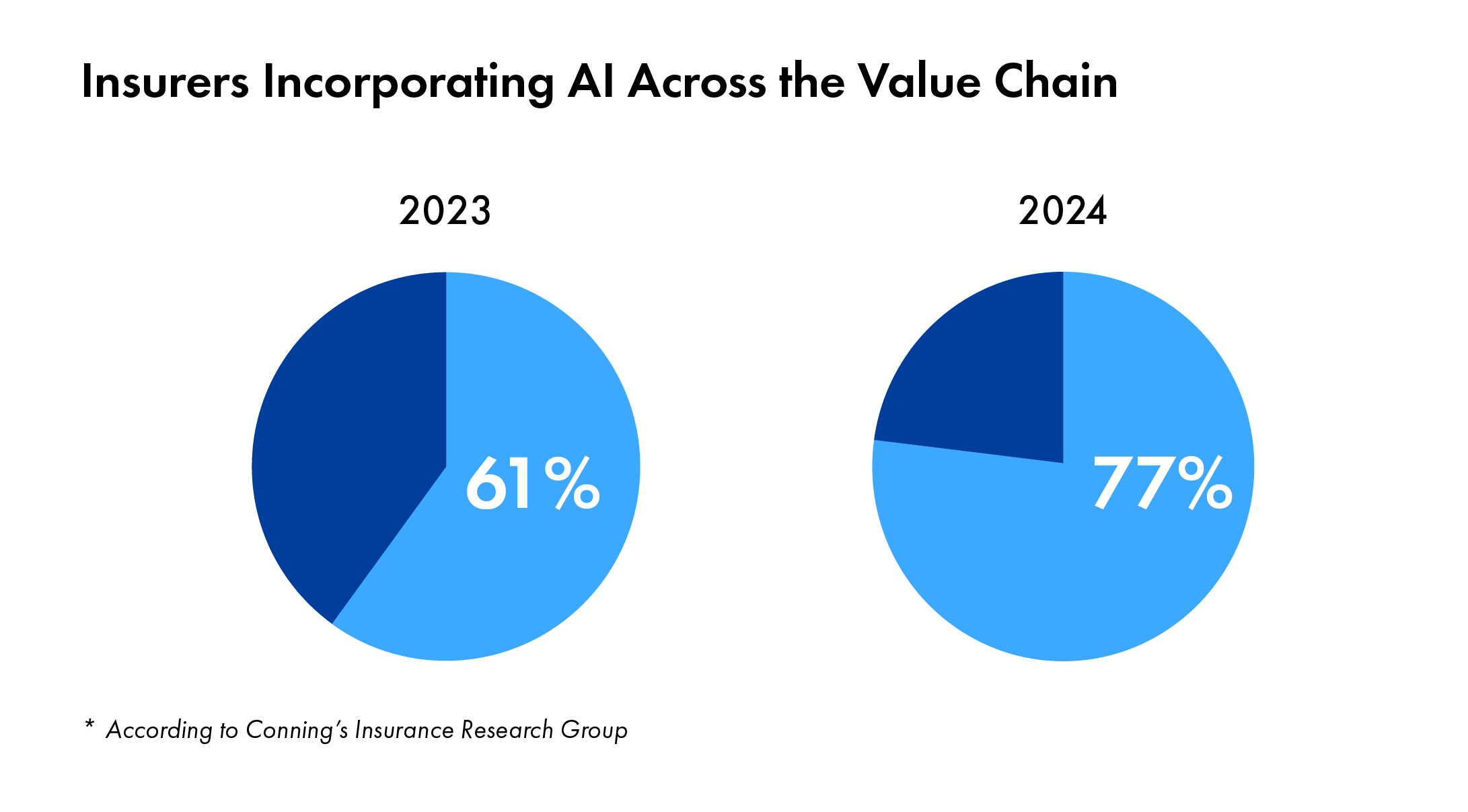

AI adoption has been steadily increasing across insurers over the last few years, particularly when it comes to managing the vast amounts of data at carriers’ fingertips. In 2023, Conning’s Insurance Research Group found that 61% of insurers had incorporated some form of AI across the value chain. 2024 results show that number has jumped to 77%.

While insurers are increasingly comfortable with the idea of adopting AI tools into their workflows to solve business challenges, generative AI is new terrain. If they leverage it properly, Bain & Company research has found that generative AI could help insurers increase their revenue by up to 20%. But given how new the technology is, many insurers are still learning what successfully applying generative AI looks like. Let’s dive into the differences between traditional and generative AI and how insurers can get the most out of each.

Comparing Traditional and Generative AI in Insurance

AI tools like machine learning, machine vision, and robotic process automation (RPA) have already helped insurers make major inroads in optimizing processes and increasing efficiency. Internet of Things (IoT) devices are helping insurance carriers monitor policyholders’ driving habits, for example, to accurately price risk or survey properties for undisclosed roof damage to reduce claims costs.

What all of these traditional AI tools have in common is that they are designed to complete a specific task, relying on explicit programming and predefined rules. In other words, traditional AI analyzes and interprets existing data to make an informed decision.

So, what exactly is the difference between these tools and generative AI? Generative AI, on the other hand, is able to generalize patterns, then generate new data mimicking the patterns of its training data. This is how tools like ChatGPT can generate text, images, and sound based on detailed prompts. With enough iterative refinement, generative AI tools can adapt to diverse data sets and learn to generate increasingly complex and varied output types.

The implications of this technology offer wide promise for everything from claims management and underwriting to distribution and operational efficiency. Because of its ability to adapt to diverse data sets and contexts, generative AI is uniquely suited to help insurers think about products and experiences in new ways through simulations, data augmentation, and co-piloting capabilities.

Harnessing these capabilities can help insurers streamline processes, enhance decision-making, and increase opportunities for innovation in ways they would not have been able to in previous eras. Of course, as with other forms of AI, it is vital for insurers to address the regulatory, ethical, and operational considerations that come along with generative AI in addition to industry best practices.

Use Cases for Different Forms of AI

The emergence of generative AI is not meant to replace traditional forms of AI. Instead, the two complement each other. Take risk assessment, for example. Predictive analytics, a type of traditional AI, can help insurers optimize their risk assessment and pricing. They can then add generative AI models into their workflow to simulate those risks, creating a more comprehensive risk analysis.

As noted above, the use of traditional AI tools like predictive models, rules-based systems, and algorithms can help insurers analyze a data set to make more accurate decisions, enhance efficiency by automating processes, and improve a carrier’s ability to identify and act on patterns.

Here are a few common use cases that are handled perfectly well by traditional forms of AI:

- Risk Assessment and Pricing. Predictive analytics models can analyze historical data to predict the likelihood of claims and set premiums accordingly.

- Claims Processing. Rule-based systems can help automate the claims handling process, from initial reporting to assessment and payout, to improve the efficiency and reduce the risk of human error.

- Fraud Detection. Algorithms can help identify potentially fraudulent claims by recognizing patterns and detecting anomalies to protect against losses.

With its ability to create new data, generative AI can help provide deeper insights than typical analytics, offer more personalized experiences, and speed up an enterprise’s capacity for innovation. Here are a few examples of how adding generative AI into the workflow can help insurers get more benefit than they can from traditional AI alone:

- Risk Simulation and Modelling. Generative AI can create complex, realistic scenarios that can help insurers gain a better understanding of potential risks and their impacts, leading to more nuanced risk assessment and the development of new insurance products to meet emerging needs.

- Personalized Marketing and Customer Interactions. Insurers can use generative AI to customize their customer communications — such as personalized advice, tailored offerings, or interactive AI-powered customer service agents — either by individual customer or by customer segment, driving better satisfaction and overall engagement.

- Product Innovation. Carriers can also leverage generative AI to help simulate various product design scenarios to address gaps in the market more creatively by offering more innovative products and services.

Developing an Enterprise Strategy for Generative AI

These are just a small handful of the use cases for enhancing an insurance organization’s operations and innovation with generative AI. With enough investment and a strategic approach to adoption, insurers can apply generative AI to wide-ranging parts of the organization, from their distribution approach and agent training to their underwriting process and onboarding of new underwriters all the way to dynamic workflow management.

Having an enterprise strategy for generative AI to guide its application is highly recommended. An enterprise strategy for incorporating generative AI into an insurer will involve organization-wide discussion of use cases and objectives, educating and training key stakeholders at all levels, and identifying technology partners and the proper platforms or tools to leverage, among other critical steps.

While devising a scalable approach to generative AI adoption will take time and attention, enterprises that successfully harness the power of both forms of AI will find themselves with a competitive edge. Investing in generative AI doesn’t mean abandoning other forms of AI; the two types of technology can be used in parallel to help insurance carriers achieve their business goals and stay ahead of their peers.

To explore another example of how insurers are improving their processes by incorporating AI, check out ValueMomentum’s case study Global P&C Insurer Uses AI-Enabled Technologies to Automate Claims & Submissions.