Digital transformation is accelerating the breakdown of traditional industry borders and end-to-end business models. As customer demands for flexibility and integrated experiences rise, more insurers are recognizing that the future of digital insurance requires leveraging digital ecosystems to reinvent products and services. With benefits such as better risk management, reduced claim cost, and new sources of revenue, digital ecosystems can drive greater economic value and relevance for today’s insurance companies.

Most insurers, however, lack the capabilities to successfully execute insurance ecosystems. Rooted in legacy systems and siloed business structures, the majority of insurance organizations will likely struggle in transitioning from generic, traditional insurance offerings to tailored, ecosystem-driven customer experiences. Nonetheless, whether it’s becoming an orchestrator or a citizen of another ecosystem, insurers looking to compete in the growing digital landscape should have a plan for incorporating ecosystems into their business model.

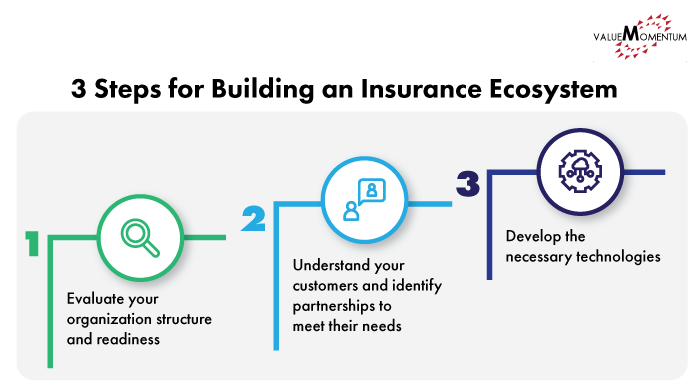

Three steps to preparing for insurance ecosystems

The journey to developing or joining an insurance ecosystem will differ between insurers depending on their specific context and goals. However, we’ve found that there are three overarching steps successful organizations take when preparing to participate in a digital ecosystem:

- Evaluate your organizational structure and readiness.

Insurance ecosystems will require insurers to reevaluate their roles as organizations and assess internally how ready they are for digital ecosystems. Strict silos and bureaucracies must be overhauled, and insurers may even need to create a separate team of digital specialists. State Farm, for instance, hired a separate chief digital officer to spearhead their digital transformation and transition from waterfall to agile methodologies.Readiness for ecosystems will also depend on building trust across an evolving system of partnerships—therefore, insurers should evaluate and prepare their organization to promote opensharing of data and foster a culture of “coopetition” to break down previous rivalries across industries. This could translate to partnerships between incumbent insurers and insurtech startups, such as Geico’s role as a broker for Lemonade’s rental insurance. - Understand your customers and identify partnerships to meet their needs.

Customer-centricity lies at the core of insurance ecosystems. As not only tech-savvy millennials, but also existing customers demand more integrated experiences, insurers need to increase contact points to deepen relationships with customers and gather valuable data for risk management. To gather data on customer expectations, State Farm, for example, text-mined customer calls and vastly expanded IT’s interaction with customers.Partnerships—as mentioned in step one—are pivotal, as they are key to meeting customer expectations. A successful ecosystem runs across adjacent industries, and good partnerships will result in not only curated offerings that meet critical needs (buying a house, car, etc.), but also seamless services tailored to each customer. As an example, Lemonade’s partnership with Avail, an online landlord-and-tenant platform, allows tenants to easily opt into Lemonade’s renter’s insurance when signing a lease. - Develop the necessary technologies.

As touched upon earlier, insurers will need to update their architecture so that it will be capable of processing the huge amounts of data emerging from digital ecosystems. This means developing application programming interfaces (APIs) to enable the sharing of data processes and algorithms to both internal and third-party partners. Such data helps insurers evaluate risk, analyze customer behavior, and share services across partnerships. APIs are the roots that connect providers, customers, and partners to constitute a digital ecosystem—for that reason, a strong API strategy will be foundational to a successful insurance ecosystem.

Open Insurance: the frontier of Digital Insurance ecosystems

Digital ecosystems are possible precisely because of data. Without a culture of sharing data, technologies to facilitate exchange and access to data, and partnerships to garner and expand access to data, insurers cannot reap the full benefits of a digital ecosystem. Customers will soon come to expect insurance propositions to cover both lifestyle risks and risk prevention. Ultimately, Open Insurance—a strategy which revolves around embracing the sharing and consumption of data across multiple sources and industries—will be key to long-term success.

Ready to join a digital ecosystem? Check out ValueMomentum’s Digital and Cloud Services to see how we can help you strategize and develop the technologies you need to succeed as an ecosystem orchestrator or partner.